I took accounting in my senior year of high school. I don’t remember much about the course but one vivid memory involves the several classes dedicated to writing checks and balancing a checkbook.

Most of the students didn’t have a clue about how to write a check or how to balance a checkbook. It was one of the few tests I felt comfortable taking.

My mom, then the general manager of a used car dealership and surrounded by numbers all day, hammered home the importance of keeping a running record of the money I spent. I didn’t have much money, being just 16 at the time, so balancing a checkbook was pretty simple.

I still write checks to pay certain bills, even for companies that offer online bill pay. In some cases paying bills by check is a simpler process. There are also certain organizations like churches, youth sports, schools and PTO and more who’ll only accept checks.

Even though I still write checks, I’ve only recently gone back to balancing a checkbook and keeping a running accounts of my expenses since I’m recently separated and awful with money. While I’m working on improving my finances, I’m interested in helping people who aren’t that well-versed in how to write a check.

Maybe this is your first checking account. Perhaps no one ever taught you how to make out a check. Maybe you’re worried about putting all of your personal information into company websites only to have it all leaked in data breaches. Whatever the case, this article is a step-by-step guide to writing checks and balancing your checkbook.

Mom will be proud unless she gets a look at my checking account balance. It’s in the negative more than the bottom of a battery.

Why You Should Balance Your Checkbook

Before diving into the procedure of writing a check, let’s first tackle the importance of balancing your checkbook.

Thanks to mom, I learned the importance of balancing a checkbook, even though I stopped doing it for a long time. Now I’m back on the bank reconciling train.

Here’s why…

I’m guilty of spending money I don’t have. In my defense, it’s money I think I have but don’t. I’ll check my account balance online and see the money in my account but will forget to take into consideration any checks I’ve mailed, automatic monthly deductions completed via autopay, checks I’ve written months earlier that people or entities are just getting around to cashing and other assorted transactions. I’ll buy something thinking I’ve got enough money and I’m suddenly low on funds, or worse, underdrawn.

Balancing or reconciling your account is easy. It only takes a few extra minutes every day and the dedication to develops good money habits. It’s also an excellent way to keep track of exactly where your money goes each month.

Here’s a quick and easy tutorial on balancing your checkbook that should become a habit.

How To Write A Check

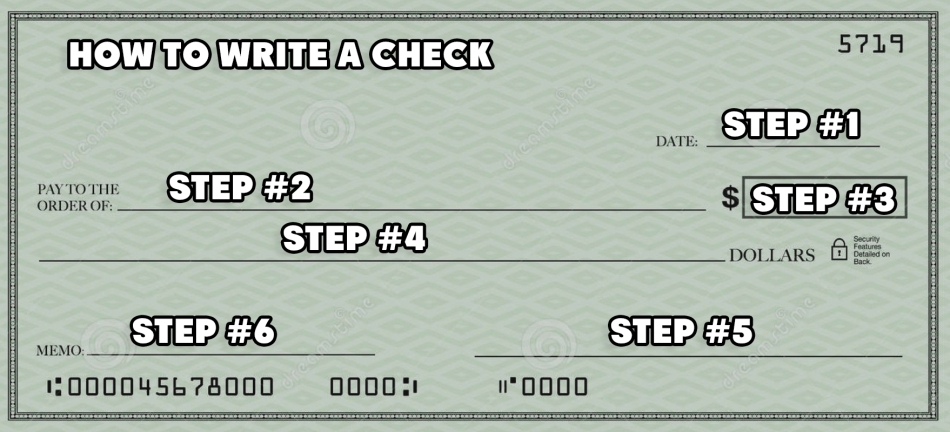

Hopefully, I’ve convinced you to keep close track of your daily spending in a checkbook. Now, here’s how to write a check in six simple steps.

Step 1: Start With The Date

The best place to start when writing a check is from top to bottom. Start with the date. Write the date clearly in either numerical or in words and make sure the year is correct. Keep in mind that a check is a legal document and the date written should always be the day that you signed the check.

Step 2: Write In The Check Recipient’s Name

Next, write in the recipient of the check in the Pay To The Order Of field. Be sure to check the proper spelling of the person’s first and last name or the preferred company name (that information it’s typically on your monthly bill). Don’t abbreviate company names unless specifically requested by the company.

Step 3: Write In The Dollar Amount On The Check

The next step in writing a check is generally the most difficult part for people but only because of the dollar amounts. No one likes writing big checks to cover bills! In the box on the right-hand side of the recipient’s name, next to the dollar sign, write in the exact amount you’re paying, using dollars and cents. For example, if the check is for fifty dollars, write “50.00.”If the check is for five hundred dollars and fifty cents, write “500.50.” Be sure to double check your bill to get the correct amount.

Read more of my work:

- I’ve Been Making A Huge Resume Mistake & Here’s How To Avoid Doing It

- How To Disconnect From Your Work When You’re Home

- Why I Wrote A Clean Joke Book And Why It Wasn’t Fun At All

Step 4: Write In The Amount – In Words – On The Check

Next, let’s pretend the amount owed is $40.42 cents. Under the Pay To The Order Of line, write in the full monetary amount of the check in words. Make sure to include the number of cents at the end. The cents should be written with the pennies amount over a line with the number 100 underneath, meaning, “42 cents out of 100.”

If the check is for an even amount, say $40, write “Forty dollars even” on the money line.

If you decide not to write even, make sure to draw a line straight across from the end of the words to the end of the check. This discourages people from adding more money to the amount and taking more from your account. Yes, sadly, things like this still happen.

Step 5: Sign Your Name On The Check

When signing my name on a check, I like to imagine it’s for a massive purchase like a brand new car or vacation home, even if I’m just paying the cable bill. I like to write my name as clearly as possible. Don’t forget to sign your name at the bottom of the check. If you don’t, the check is invalid, and it will be sent back by the company or individual.

Step 6: Fill In The Memo Line On The Check

Though filling out this part of the check is optional, it’s helpful to make a note to remind yourself what the check is for, especially when paying an individual. You know why you’re paying a friend $70 right now, but you might forget in a couple of months when you’re going over statements or getting ready during tax time.

Some companies request your account number or customer number in the memo line. It’s an easier way to apply this payment to your account or find your account in their system on the off chance the check gets misplaced.

An Awesome Story About The Memo Line

Lisa Nichols is a 6-time best-selling author and world-renowned motivational speaker. Watch this short video where Lisa talks about the way she used the memo line of checks as a motivational tool and how writing the same phrase over and over again on checks changed her life.

Step 6: Double Check Everything

Finally, the most critical step with everything you do. Check your work. Make sure the check is correct, drop it in an envelope, and you’re ready to go.

And you’re done. Writing a check is just that simple. As a show of thanks, go ahead and write me a $1 check and send it along. Practice makes perfect and I could use the money.

Thanks for reading! If you dug this article, please take a second to like, comment, or share this with friends or random strangers. If you’re new to the website, please check out my archives, and take a second to follow me on FACEBOOK, LINKEDIN, TWITTER, INSTAGRAM or TUMBLR.

0 comments on “How To Write A Check And Why Balancing Your Checkbook Is Still Important”